The fundamental view over the Returns to Shareholders

Our basic policy on profit sharing is to pay dividends based on consolidated payout ratio of around 40% or above, comprehensively taking into consideration our medium-term profit forecast, investment plans, and cash flows.

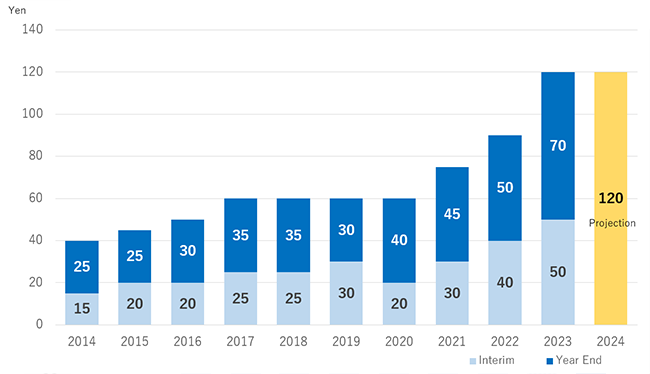

History of our dividend

- *The starting of paying a dividend-interim dividend : Late in August / year-end dividend : Late in March

Status of Treasury Stock

| Acquisition period | Means of acquisition | Aggregate number of shares acquired |

Acquisition cost |

|---|---|---|---|

| November 5, 2013 to December 12, 2013 |

Market purchase in the form of trust |

3,402,900 | 5 billion yen |

| October 24, 2012 to December 3, 2012 |

Market purchase in the form of trust |

4,248,200 | 5 billion yen |

| November 8, 2010 to December 3, 2010 |

Market purchase in the form of trust |

4,348,500 | 5 billion yen |

| October 24, 2008 to November 12, 2008 |

Market purchase in the form of trust |

3,406,100 | 5 billion yen |

| August 11, 2008 to September 11, 2008 |

Market purchase in the form of trust |

2,861,300 | 5 billion yen |

| February 14, 2008 to March 11, 2008 |

Market purchase in the form of trust |

2,764,700 | 5 billion yen |

| October 23, 2007 to November 27, 2007 |

Market purchase in the form of trust |

2,257,200 | 5 billion yen |

| August 10, 2007 to September 5, 2007 |

Market purchase in the form of trust |

2,368,300 | 5 billion yen |